Understanding Your Award Letter & Micro-Scholarships

We break down the college financial aid award letter, where RaiseMe micro-scholarships fit in, and what exactly it means for you and your family when it comes to paying for college.

When it comes to the college financial aid award letter, the amount of terminology that seems necessary to break down can be at times overwhelming. What’s the difference between federal scholarships and grant aid? How do institutional grants and need-based aid differ? What is work-study? What is a Pell Grant, Perkins loan, and the FAFSA? And finally, how can I get micro-scholarships from colleges when I apply?

Fortunately, while college financial aid might seem confusing at first, there are a few important things to understand about how colleges award financial aid to prospective students.

What is an award letter?

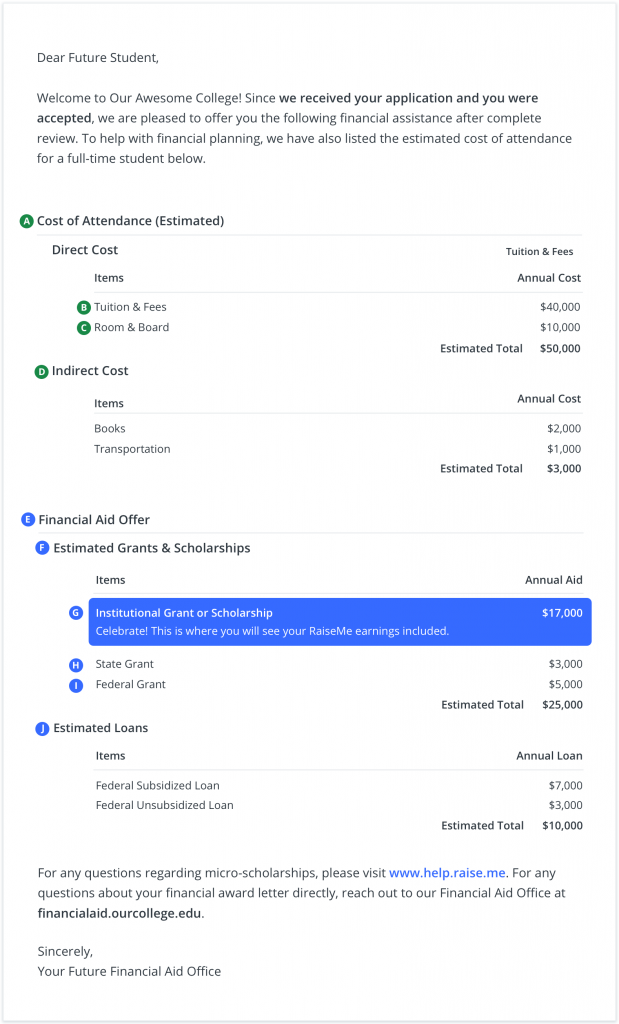

An award letter is a document that colleges will send to admitted students containing information about the financial aid and grants awarded to that student based on academic merit, financial need, and other considerations. The award letter typically contains information like the estimated cost of attendance (including direct costs like tuition and board, and indirect costs like textbooks and school supplies), estimated scholarships and grants from the university, and estimated loans.

How should I interpret my award letter from a college?

In the below image, we’ve broken down what each component of a college award letter represents, how RaiseMe micro-scholarships fit in, and what it all means for you and your family. Follow the letters beneath the image to understand how each component of a financial aid award letter may differ.

A. Cost of Attendance

This is the estimated cost to attend this school for one academic year before financial aid is applied (sometimes it is broken out into Fall and Spring terms). It includes everything from fixed costs like tuition to variable costs like personal expenses.

B. Tuition and Fees

This is the price of the classes you will take and other mandatory costs of campus life. Most

financial aid will only go towards tuition. Your micro-scholarships, which reflect institutional grants and scholarships help to pay for tuition only.

C. Room & Board

This is the cost for the poster boards for all the book reports you’ll be doing. Psych! It’s a funny term for the estimated cost to live either on- or off-campus and eat breakfast, lunch, and dinner (often called a meal plan) – no snacks! The actual charges for room and board may vary based on your housing decisions (on-campus v. off-campus, single-room v. shared-room)

D. Indirect Costs

Indirect costs are educational costs you will need to pay–like books and supplies, travel, and personal expenses such as laundry, snacks, and entertainment. These costs can vary based on your choices (e.g., buying used books, late night pizza every night).

Net Price – what will my cost be?

Don’t worry – the Net Price (the money you and your family will actually pay) is often much less than the Estimated Cost of Attendance listed.

Net Price is the Direct Cost of college (tuition, fees, roam & board) minus any Grants and Scholarships you may receive.

(Direct Cost – Grants and Scholarships = Net Price)

E. Financial Aid

Your financial aid offer is money to help you pay for the cost of attendance. It may include money you will not need to pay back (i.e., scholarships and grants) or money you need to pay back or work for (i.e., loans, work-study). One thing to note – it can’t be larger than the cost of attendance. While it’d be nice, that would mean they are paying you to go to school!

F. Estimated grants and scholarships

Grants and scholarships , sometimes called gift aid, are money awarded to you that you do not need to pay back. It can either be awarded based solely on the financial situation of your family (i.e, grants) or based on your academic and extracurricular achievements from high school (i.e., scholarships) or both. Gift aid may come from the federal or state government, the college, or outside private organizations.

Institutional Grants & Scholarships (RaiseMe)

Celebrate! This is where you’ll see at least what you’ve earned on RaiseMe. This is aid you’ll receive directly from the college. Institutional grants and scholarships can have all sorts of names, like the President’s Scholarships, Wildcat Excellence Award, or University of Arizona Grant.) Note, this number should always be greater than or equal to your RaiseMe earnings. If the number is greater, pat yourself on the back — it means the college has decided to award you even more than was guaranteed on RaiseMe! Woohoo!

H. State Grants

This is aid you receive from your home state for attending a college or university in your home state. Being a local pays off!

I. Federal Grants

These are need-based awards, the most common of which is the Pell Grant. You’ll need to complete the FAFSA to see if you qualify. Fill out your FAFSA starting Oct 1 of your senior year to see if you qualify for financial aid. Check out fafsa.ed.gov for deadlines.

J. Estimated loans

This is money that you borrow and must pay back over time with interest. There are different types of loans that have different terms, so be sure to research the loans proposed in your award letter.

Interested in understanding more about college financial aid? Check out our explainer article that breaks down all the nitty gritty details here.

You may also like

Introducing RaiseMe’s College Readiness Workshops: A Virtual Series for Students and Parents

Interact directly with colleges in our new series designed to help you feel supported in your college search journey this fall,...

Financial Aid 101: Webinar Recap

Most students who have begun to research colleges or work on college applications have some sense of what financial aid is, and how receiving financial aid can remove some of the financial burden of paying for...

Virtual Info Session: Financial Aid 101 with RaiseMe Partner Colleges

Get smart about financial aid and paying for college in an info session with RaiseMe, Carnegie Mellon, and others.